Attention: ASX Company Announcements Platform

Lodgement of Market Briefing

Weebit Nano’s Chairman and CEO on company strategy to accelerate market adoption of its ReRAM technology and path to revenues

Interview with Dadi Perlmutter (Chairman) and Coby Hanoch (CEO)

In this Market Briefing interview, Weebit Nano’s Chairman Dadi Perlmutter, and CEO Coby Hanoch, discuss the stand-alone memory market opportunity, and how Weebit continues to pursue its growth strategy in the embedded memory market. The briefing includes:

- How the semiconductor industry is driving the new digital world, with memory being the fastest growing segment of the semiconductor industry and also the largest at US$60 billion currently

- Impacts of COVID-19 and how Weebit Nano has responded

- Weebit Nano’s accelerated entry into the discrete “stand alone” memory market

- Substantial time and money being saved through utilising Leti’s selector technology in the stand-alone market

- Weebit Nano’s growth strategy for the embedded memory market and expectations for first agreements

- Progress being made with XTX Technology and SiEn, and the broader China opportunity

- Key upcoming milestones for Weebit Nano, including first strategic agreement still being targeted for the end of this year

Market Briefing

High tech industries, particularly the semiconductor sector, are not easily understood, and many investors aren’t overly familiar with what semiconductors do and their importance to the world. Can you provide us with some background to the semiconductor industry?

Dadi Perlmutter

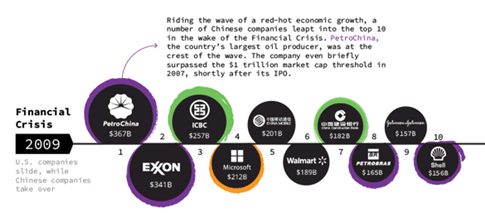

The world we are living in is becoming increasingly digital. This has been further highlighted under the current global COVID-19 coronavirus pandemic, that has seen communication, human interaction and entertainment all become digital. Could we imagine our life without being able to connect to everything we used to do in person, via our computers and smartphones? Moreover, cars, televisions, refrigerators, washing machines and most other appliances are now “smart”. To put things into perspective, in 2009, nine of the 10 largest companies in the world were industrial, financial services, and oil and gas companies. Only one was digital.

Source: Visual Capitalist: https://www.visualcapitalist.com/a-visual-history-of-the-largest-companies-by-market-cap-1999-today/. Orange: digital; purple: energy; green: finance; and white: consumer.

Ten years later, in 2019, seven of the 10 largest companies in the world are digital companies.

Source: Visual Capitalist: https://www.visualcapitalist.com/a-visual-history-of-the-largest-companies-by-market-cap-1999-today/. Orange: digital; green: finance; and white: consumer.

The digital age is upon us, and the pace of this digitisation is only going to increase.

When we talk about “digital”, we are talking about semiconductors. Semiconductors are the basic components used in making advanced electronics and communication systems, and without them these seven companies would not exist. We say we back up our pictures and videos to the “cloud”, but what is the “cloud”? It is comprised of huge data centres full of non-volatile semiconductor memories.

Processing, memory and communications technologies are in high demand to keep up with the computation and storage requirements of the global digital economy. In particular, memory is the largest and fastest growing sector of semiconductors, and the non-volatile memory market that Weebit is targeting is valued at over US$60 billion, and is expected to reach US$82 billion in 2023 and over US$100 billion by 20251.

The semiconductor industry really is the building block of our new age economy, and will be even more so after the COVID-19 crisis.

Market Briefing

Before we discuss the semiconductor industry and Weebit Nano in more detail, it would be good to hear how Weebit Nano is being impacted by COVID-19, and how the Company has responded?

Coby Hanoch

Like most of the market, Weebit Nano has been impacted by the virus on several fronts. Our French-based development partner, Leti, has been temporarily closed in line with country-wide French Government directives, and this obviously slows our development efforts. Our Israel-based team members are also working from home, although this is not expected to have any material impact to our operations.

Given the current environment we are operating in, we have taken decisive actions around reducing operating expenses, implementing a travel freeze, Directors not drawing fees, reducing employee salaries, etc. Pleasingly, our team is continuing to work intensively around our potential partners and customers, especially the Chinese partners that are back to almost full speed, and we are making very good progress on these fronts.

Market Briefing

You mentioned China. While the semiconductor industry is growing rapidly to support the global digital economy, China in particular appears to have a major focus on investing in this sector. Can you tell us more about this?

Dadi Perlmutter

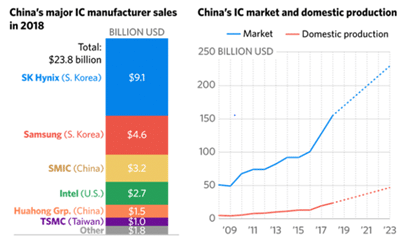

The Chinese understand that semiconductors are the fuel of the new digital economy. We are seeing a huge push by China to grow its semiconductor industry. Two of the top 10 companies globally are digital Chinese companies – Alibaba and Tencent. A core pillar of China’s “Made in China 2025” plan is to boost its semiconductor industry, and their aim is to produce 80 percent of semiconductor consumption domestically. China is currently building around 30 semiconductor fabrication facilities, each one an investment of between US$2 billion and US$15 billion, to support the growth in semiconductor technology it is seeing.

China is the largest user of semiconductor technologies in the world, and even at current investment levels they can’t keep up with the growth in market demand. When you look at what causes the gap you can see it is mostly the imports from Samsung and Hynix, which are the top two non-volatile memory companies in the world. If China wants to move to the forefront of the semiconductor industry it has to do this via the memory market.

Source: IC Insights, Inc.

With limitations in current memory technologies, China sees the adoption of emerging memory technologies as its chance to leapfrog its position in the semiconductor industry. In a way, this is very similar to what Korea did about twenty years ago, when they decided to invest heavily in advancing their position in the semiconductor industry, which was then dominated by Japanese and American companies. We saw a similar analogy in cellular phone technology, where China bypassed fixed line technology and invested heavily in cellular technology and is well-advanced in rolling out the world’s largest 5G phone network.

Now that China is returning to full speed while the rest of the world is still battling COVID-19, we are seeing them even more eager to use this opportunity to leapfrog forward in semiconductor technology, and we have great cooperation with SiEn, XTX and other Chinese companies.

Market Briefing

Weebit Nano recently announced its accelerated entry into the discrete, or “stand-alone”, non-volatile memory market. What drove this decision, and what does this mean for the Company’s strategy in the embedded memory market?

Coby Hanoch

Firstly, I would like to say that we always intended to enter the stand-alone memory market, and it was originally in our plans for late 2021. This is a huge market opportunity. Almost every technology-rich device that we use in our daily lives, such as phones, laptops, and data storage devices, features stand-alone memory.

When we started talking to customers about our embedded ReRAM technology, we realised there was also strong demand for ReRAM in parts of the stand-alone memory domain. Specifically, XTX Technology and other potential customers we were in discussions with pushed us to accelerate our plans in the stand-alone domain, specifically in the NOR Flash domain, given the potential they saw for our memory technology in their products.

After signing the Letter of Intent [LOI] with XTX Technology in August 2019, they immediately wanted to validate Weebit Nano’s technology in their facility. This was achieved in December 2019, four months ahead of schedule, and was a very important milestone for us. It is important to note that allocating a team and the lab for this testing is not a trivial decision for a CEO, as they could be doing other activities which generate revenues for their company.

Given XTX Technology’s focus on the stand-alone market, and their desire to aggressively explore the integration of ReRAM technology into their products, we took a closer look at this market segment. The key issue was that in order to address this market we would need to develop an advanced element called a “selector”, which is highly complex. Unlike the case of ReRAM in embedded memory applications, a selector element is an absolute must for stand-alone implementation of the ReRAM technology.

As it stands, we are very fortunate that Leti, our French-based development partner, has been developing a selector for the stand-alone memory market for more than five years. This will enable Weebit to save many years and tens of millions of dollars from our development program.

So, in a sense, there has been a combination of two major ingredients for Weebit’s entry into the stand-alone memory market – potential customers who are very interested in our technology, and fast-tracked access to a selector saving substantial development time and money. We grabbed this opportunity with both hands, as it shortens development time by years and significantly reduces risk.

I should be very clear that this has no impact on Weebit’s plans for the embedded memory market. We slightly pushed out the timing for the delivery of the memory module for the South Korean partner while we dedicated resources to the XTX technology validation. However, we remain heavily committed to the embedded memory market and are continuing to push for first orders in late 2020.

Market Briefing

You talked about having access to the “selector” that your development partner, Leti, has been developing. Can you provide more detail on the significance of this?

Dadi Perlmutter

A ReRAM memory array requires each memory bit to have an element called a selector, so that when you write to specific bits, they are the only ones selected and the rest of the bits are not. This is what enables ReRAM to use 1,000 times less power than 3D NAND, as only the selected bits are activated and the rest of the huge array is kept asleep versus 3D NAND where big portions of the array are selected to perform a WRITE operation [writing new data into the selected bits of the array].

In the embedded world we just use a transistor as a selector. This is very simple and straight-forward, with one disadvantage – the transistor is very big. In the embedded memory domain this is not critical, as the memory occupies a small part of the chip, so this has little impact on the total size of the chip.

However, as stand-alone memory chips are all memory, the size of the selector is critical and requires a replacement for the transistor as the selector. Small selectors are very difficult to develop.

Leti have been developing a selector for the stand-alone memory market for more than five years, and we have been able to extend our collaboration with them to work on integrating their selector with our ReRAM technology. This saves us years of development time and tens of millions of dollars.

Our goal is to demonstrate the ReRAM cell intended for the stand-alone memory market by mid-2021. In parallel, we expect to continue discussions with XTX and other potential customers, in respect of Weebit’s commercialisation plans for this market.

Market Briefing

What is the status of your collaboration with Chinese semiconductor company XTX Technology?

Coby Hanoch

XTX Technology has been very keen to collaborate with Weebit Nano, and to integrate emerging technologies into their products. Following their successful independent external technology validation in December 2019, we are now in technical discussions defining how to integrate Weebit Nano’s unique ReRAM technology into their products. Obviously, things were put on hold as China navigated COVID-19, but with China back online we are now very actively engaged with XTX.

Market Briefing

You also recently announced a collaboration with SiEn (QingDao) Integrated Circuits Co., Ltd. [SiEn], another Chinese semiconductor company. Can you provide some further details on this?

Coby Hanoch

We were really excited about our collaboration with SiEn. This company was established by Dr Richard Chang, who is known as the “Father of the Chinese semiconductor”, having founded China-based Semiconductor Manufacturing International Corporation [SMIC], China’s largest contract chipmaker. Richard is a long-term associate of our Executive Director Dr Yoav Nissan-Cohen. Dr Chang also established Worldwide Semiconductor Manufacturing Corp [WSMC], which was acquired by Taiwan Semiconductor Manufacturing Corp [TSMC], the world’s largest semiconductor foundry.

Now that SiEn is also back operating, we are having intense technical interactions with the goal of embedding Weebit Nano’s ReRAM technology into SiEn’s products to significantly enhance its offering. In these discussions we learned that the SiEn fabs are based on the same technology that Leti uses and Weebit Nano’s tools were developed with. This means the technology transfer should be even simpler and easier than originally expected.

Beyond SiEn and XTX we are talking to other semiconductor companies in China and elsewhere, and are seeing strong interest in our technology.

Market Briefing

With so much development occurring in China, what is your view on the risks of IP theft in this market?

Coby Hanoch

In the semiconductor industry, and probably in any industry really, IP protection is critical. IP theft also occurs outside China, so whether we are dealing with US, South Korean or Chinese companies, we place great importance on protecting our IP.

Our Board and management has many decades of accumulated experience working successfully with Chinese companies. Dadi was responsible for Intel’s growth in China, Atiq sold several companies to Chinese companies, Yoav cooperated with fabs in China, and I have been selling to the Chinese for 20 years.

We all understand that you can never be too careful, and we have experienced IP lawyers currently working on filing our patents in China. As China develops more and more of its own IP, the Chinese government has been clamping down on IP violations and improving legal protection of IP, and having our patents registered there is an important protection.

We have also hired Jackson Lam as VP Strategic Alliances, China, leveraging his deep understanding of the Chinese market and how it works. Additionally, our lawyers, King & Wood Mallesons, are an Australian-Chinese firm with broad experience in protecting IP in China.

Market Briefing

How is Weebit Nano positioned so well and been able to achieve significant progress in a short period of time when other emerging memory technology companies have been struggling?

Dadi Perlmutter

Weebit Nano has many semiconductor industry veterans on its Board and management team. We know that a very good product is still not a guarantee for success. It needs to be competitive, easy to manufacture and allow for attractive profit margins.

Weebit Nano’s biggest competitive advantage is that we managed to develop our ReRAM technology using Silicon Oxide [SiOx], otherwise known as glass, without having to add any non-standard material like other companies are doing. SiOx is the most commonly used material in the semiconductor industry.

All fabrication facilities, which are worth billions of dollars, and all production processes, have been built around SiOx. Fabs are very delicate facilities, with clean rooms that are 1,000 times cleaner than where you perform open-heart surgery, and it is very difficult to introduce new materials into them. SiOx is more manufacturable, reliable and cost-effective than any other material in this industry, making Weebit Nano’s ReRAM technology significantly more attractive to customers and fabrication facilities. This is a huge competitive advantage in terms of manufacturing ease, but also in terms of supporting faster progress of our technology development and commercialisation.

As mentioned earlier, China is currently building around 30 fabrication facilities, which are all based on standard manufacturing with SiOx, which positions Weebit Nano very well in that market.

Weebit has been able to achieve greater progress with its technology development in four years than what other ReRAM technology companies have been able to achieve in 10 or more years. This has obviously also saved Weebit Nano, and its shareholders, millions of dollars.

Market Briefing

What is the status of the work in the embedded memory market? When does Weebit Nano expect to announce its first sales?

Coby Hanoch

First, I want to make sure it is clear to everyone what an embedded memory is. As most people know, semiconductors are shrinking rapidly, so that you can now place a whole system on a single chip, including the processor, communication, memory, etc. The memory is “embedded” into this System-on-a-Chip [SoC]. While “stand alone” memory products are, and will continue to be, the largest portion of the memory market, analysts predict that embedded memory will grow faster and will grab a larger portion of the memory market. The heart and brains of the vast majority of digital devices today are SoCs.

As a refresher, we have been working with a South Korean company that is a top 10 global analogue company, with its own fabrication facility. They use 200mm and large geometries [greater than 40nm], so they are a great fit for our technology as it stands. We are also working with SiEn in this domain and the transfer of the technology to the SiEn fabs is expected to be even easier and faster than the Korean partner fab.

We are currently working on the “memory module”, which is the element that wraps Weebit Nano’s memory array and interfaces with the rest of the system. It should be noted that our team already developed such modules in the past so this is a low-risk activity, but it is a task that takes time and effort.

The pleasing aspect of the memory module work is that it is being configured in a way that will largely enable it to be customised for any customer, meaning once it is completed, we can use it with both SiEn and the Korean partner.

As I mentioned earlier, we had to shift resources and push back our expectation for the completion of the memory module to focus on the independent technology validation work with XTX Technology. The COVID-19 shutdowns have, and continue to, impact us. However, we are doing everything we can to avoid further delays in the module delivery.

Having said that, we are still aiming for first agreements in the embedded memory market by the end of this year.

Market Briefing

Dadi, you have a very accomplished background in the semiconductor space, having held very senior roles at Intel Group for a long period of time. There are also other semiconductor industry stalwarts on the Board in both Dr Yoav Nissan-Cohen and Atiq Raza. The three of you must have many offers to join technology start-ups and established companies. What is it that drew you to Weebit Nano?

Dadi Perlmutter

I have worked in the semiconductor industry for 40 years, mostly with Intel. This industry is what I know and what I love. I am also passionate about Israeli technology companies, so when the opportunity to become an investor in Weebit Nano and join the Board presented itself, I was immediately interested.

Having led the development of Intel’s Pentium chip, I can clearly see the limitations with current memory technology. There is a clear need for a new memory technology that will allow our semiconductor industry to keep pace with technological advancements.

Many companies ask me to join their Board and/or work with them. When assessing opportunities to become involved with a start-up technology, the key considerations for me are: who are the people involved, is there a need for this technology, and can I add value to the company? Weebit Nano ticked all of these boxes. And a big plus is that it was an Israeli company.

Since I joined the Board, we have been able to add significant capabilities to the leadership team, and importantly, very specific semiconductor technology capabilities.

Dr Yoav Nissan-Cohen brings a deep understanding of memory technology, with 40 years of scientific research, technology development, and executive management in the semiconductor industry. He obtained his PhD under Prof Dov Frohman, who invented the very first non-volatile memory [NVM], so he has been in this industry since day one. He started his career as a research scientist in GE’s R&D centre in New York, where he studied the use of Silicon Dioxide in semiconductor memory devices. He then led the spin-out of National Semiconductor’s fab, creating Tower Semiconductor, where he was CEO for nine years and listed it on Nasdaq. Today, Tower has a market cap of US$3.4 billion. He also co-founded Saifun, another NVM company which he sold to Spansion.

We also appointed Atiq Raza to the Board. I knew Atiq from the days he made NexGen, and then AMD, a true and fierce competitor to Intel on its leading-edge processors. Atiq was a well-respected competitor combining very deep technical understanding with an exceptional talent for defining strategy and running businesses. He has held multiple roles as investor, Chairman and CEO of semiconductor companies, so he also brings a wealth of relevant experience.

With Coby, who has been involved in two successful technology exits, and has set up global sales organisations selling to the semiconductor market as CEO, I believe we have a leadership team to rival any in the semiconductor technology industry, and one that is well placed to realise the huge potential of Weebit Nano.

Market Briefing

What are the key upcoming milestones that investors should be keeping an eye out for?

Coby Hanoch

As we have covered in this interview, there is a lot happening at Weebit Nano.

In the embedded memory space, we are continuing to work on the memory module, with the aim of delivering it before the end of this calendar year. In parallel, we are also planning on achieving first customer agreements before the end of the calendar year.

Once the memory module is complete, we will have a significant opportunity to take our embedded memory offering to the broader market, and generate additional sales orders.

In the stand alone market, our development program is centred around integrating Leti’s selector with our ReRAM technology. Stage one will be three-months long and used to define the specific details of the selector, and then based on that, the commercial details. Once these details are defined, we will focus on demonstrating Weebit Nano’s ReRAM cell working with the selector by mid-2021. We will provide regular updates on the selector development.

And of course, there are many commercial discussions taking place that may, or may not, require disclosure to the market. These could take various forms, be it in sales orders, financial commitments to development, or strategic investments.

So there should be quite a bit for investors to keep an eye out for over the coming period.

Market Briefing

Thank you, Dadi and Coby.

1 Source: MarketsandMarkets Research Private Ltd: https://www.marketsandmarkets.com/Market-Reports/non-volatile-memory-market-1371262.htmll

This Market Briefing has been authorised for release by the Board.

For further information, please contact Eric Kuret, Market Eye, on +61 3 9591 8900, [email protected]

DISCLAIMER: To the full extent permitted by law, readers of this Market Briefing are solely responsible for their use of the information contained in it, and Market Eye Pty Ltd (Market Eye) shall have no liability in relation to the information in this Market Briefing, the use of that information and any errors or omissions in this Market Briefing, including (without limitation) any liability for negligence or consequential loss. This Market Briefing is based on information provided to, and not verified by, Market Eye. Any statements by the participant company regarding future matters may reflect current intentions and beliefs of that company, may be subject to risks and uncertainties, and may be materially different to what actually occurs in the future. The information in this Market Briefing is not intended to be complete, or to provide a basis for making any decisions regarding investments. Nothing in this Market Briefing should be construed as financial product advice, whether personal or general, for the purposes of section 766B of the Corporations Act 2001 (Cth). Market Eye recommends that readers obtain independent investment advice prior to making any decisions regarding investments.